The luxury fashion industry is on the brink of a significant transformation, with the Prada Group eyeing a potential acquisition of Versace. According to a report from Reuters, Capri Holdings—the parent company of Versace, Michael Kors, and Jimmy Choo—is contemplating selling its brands. Among the parties interested in this opportunity, Prada, advised by Citi, has notably expressed strong interest in acquiring Versace. This strategic move could substantially enhance the global reputation of the “Made in Italy” heritage within the luxury market.

Capri Holdings has faced some well-documented financial hurdles, prompting them to place both Versace and Jimmy Choo on the market as early as December 2024, following a failed merger attempt with Tapestry. Versace, a name synonymous with luxury, boldness, and a touch of daring creativity, stands in stark contrast to Prada, known for its sophisticated and understated elegance. Each brand caters to different aesthetic sensibilities, occupying unique positions within the fashion landscape.

In 2023, luxury American brand Tapestry announced its plans to acquire Capri Holdings to enhance its competitiveness against European luxury leaders. Tapestry’s CEO, Joanne Crevoiserat, articulated that the merger of Coach, Kate Spade, and Stuart Weitzman with Versace, Jimmy Choo, and Michael Kors would create a formidable new luxury powerhouse. In response, Capri’s Chairman and CEO, John Idol, emphasized that partnering with Tapestry would equip them with additional resources to expand globally while maintaining their brands’ unique identities.

Is it possible that Prada Group is considering a similar strategy?

What Prada Stands to Gain:

The strikingly bold style associated with Versace could provide a refreshing complement to Prada’s renowned understated elegance. By acquiring Versace, Prada would not only diversify its market presence but also attract consumers who are drawn to a more glamorous, maximalist aesthetic. Moreover, Versace’s firm foothold in the North American market—a territory where Prada’s influence has historically been less pronounced—promises immediate opportunities for growth. Bain & Company notes that North America represented about 34% of global luxury sales in 2024, indicating that such an acquisition could vastly amplify Prada’s market impact.

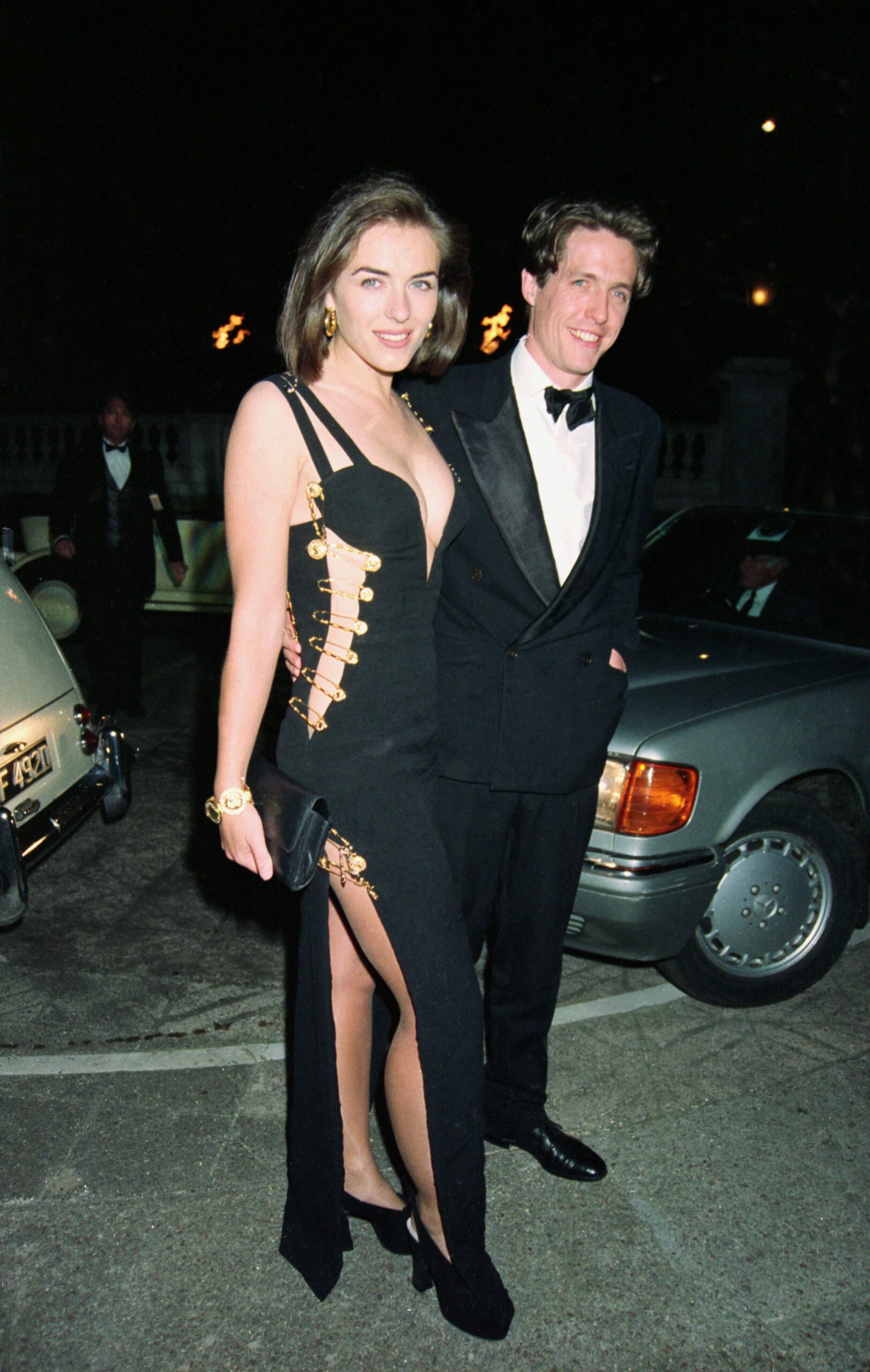

Additionally, few brands match Versace when it comes to their lively connections with Hollywood and pop culture. The brand’s history is marked by notable moments, such as when the late Gianni Versace lent the “Versace pin dress” to a then-unknown Elizabeth Hurley for the premiere of Four Weddings and a Funeral in 1994. This moment propelled both the dress and Hurley into the public eye, marking a pivotal turn in their respective careers.

And let’s not forget Jennifer Lopez’s unforgettable appearance in the iconic green jungle-print Versace dress at the 2000 Grammy Awards. The massive search for images of this daring outfit even led Google to realize the need for an image-specific search engine, resulting in the creation of Google Images. This moment solidified Versace’s reputation for audacious designs that celebrate sensuality and established a strategy focused on making waves with high-profile celebrity endorsements.

Recently, Donatella Versace showcased her collaboration with singer Dua Lipa in the launch of their co-designed women’s collection during Versace’s High Summer “La Vacanza” fashion show held on the scenic French Riviera in 2023. Similarly, Prada has also leveraged celebrity influence, with its Autumn/Winter 2022 menswear line featuring prominent actors like Thomas Brodie-Sangster and Jeff Goldblum, aligning itself with the current trend of celebrity endorsements in luxury fashion.

Why Now?

Looking at financial performance, Versace has recently reported a significant downturn, with revenues of USD 201 million in the second quarter of the 2025 fiscal year ending September 28—a striking 28.2% drop compared to the same quarter in the previous year. In contrast, Jimmy Choo, another luxury brand under Capri Holdings, has seen a revenue uptick, reaching USD 140 million. This stark disparity underscores the challenges faced by Versace, further emphasizing its financial strain within the Capri portfolio.

On the other hand, Prada reported robust double-digit growth, achieving EUR 3.829 billion in revenue during the first nine months of 2024. With prominent labels like Prada and Miu Miu to its name, the Milan-based conglomerate stands to enhance its portfolio by adding such an iconic brand as Versace. However, Versace’s recent substantial revenue decline—recorded at 28.2% for the second quarter of 2024—only complicates the picture for Capri Holdings, which recently attempted, but failed, to merge with the American group Tapestry, valued at approximately EUR 8.24 billion.

So, why would Prada consider acquiring Versace during this shaky economic climate? The answer may lie in strategic opportunity—economic downturns often create openings for investing at a lower valuation. Capri Holdings has faced considerable difficulties with Versace’s profitability, and this vulnerable financial situation creates a prime opportunity for Prada to strike a favorable acquisition deal. The current economic landscape, characterized by reduced valuations across various industries, makes this offer all the more appealing.

Moreover, the luxury sector is experiencing a pattern of consolidation, where larger entities are acquiring smaller, albeit renowned, brands to consolidate their market influence. Prada’s strategy could serve both a defensive and an opportunistic purpose, ensuring it maintains its competitive stance against conglomerates like LVMH and Kering. Emphasizing the significance of the “Made in Italy” legacy further reaffirms Prada’s commitment to championing Italian craftsmanship and heritage against the French luxury titans.

However, potential pitfalls loom. Striking a balance between maintaining Versace’s audacious identity and aligning it with Prada’s foundational ethos will necessitate thoughtful navigation. With global inflation and economic uncertainty potentially affecting luxury spending, this could be a risky moment for significant capital undertakings. Reviving Versace’s profitability may require operational restructuring, which may not sit well with current stakeholders.

All That Glitters…

On the flip side, there are reasons to remain skeptical about the acquisition. Historically, Prada has been conservative with acquisitions, preferring to focus on organic growth and nurturing its current brands. As mentioned by Reuters back in October 2024, Miu Miu surpassed expectations, contributing significantly to the group’s total retail sales. Throughout the year, the Prada Group demonstrated healthy growth, reflected through positive revenue and margin improvements. Over the first nine months, revenues had reached around EUR 3.8 billion. While the luxury fashion market faced various downturns, Prada experienced a 16% rise in revenues, driven by increased Miu Miu sales and a noticeable boost from the Asian market, particularly from China and Japan.

Prada’s recent financial success—posting double-digit growth in 2024—suggests a strong position for the company, but it raises a valid question: why take on the uncertainties of acquiring a struggling brand like Versace when Prada is flourishing independently? Furthermore, both Capri Holdings and Prada have not made any official announcements, leaving a veil of speculation and industry gossip that may not always reflect the reality.

Interestingly, these rumors could benefit Prada by keeping it in the limelight and solidifying its reputation as a serious player in the luxury market’s consolidation narrative. Associating with a high-profile potential acquisition signals ambition and financial prowess to both competitors and investors, even if no formal agreement comes to fruition. This strategic perception management ensures Prada remains a key topic in discussions about the future of luxury.

Ultimately, the prospective acquisition of Versace by Prada might represent a daring ambition to redefine the luxury fashion landscape. While the timing appears precarious, it might also serve as the opportune moment to capture an iconic brand at a critical juncture. For Prada, this endeavor transcends mere business—it is an expression of intent to reshape luxury for a new era. The ultimate question is: can Prada successfully merge two distinct yet complementary legacies to forge a formidable brand for the future? Only time will tell.