The super-rich are expected to continue influencing the global financial landscape in 2024 through their business ventures and strategic investments. According to Forbes, which has monitored billionaires and their wealth for decades, the fortunes of the world’s richest people reached USD 14.2 trillion in April 2024. This marks a 14 percent rise from USD 12.2 trillion the previous year. Here’s a detailed look at how billionaires engage in trading and investment, and how their methods set benchmarks in the financial sector.

The Titans of Trading and Investing

Many of the wealthiest billionaires in 2024 have built their fortunes by actively engaging in stock markets, private equity, and speculative investments such as cryptocurrency. Figures like Elon Musk, Jeff Bezos, and Bernard Arnault own some of the most valuable companies globally and manage diversified portfolios that keep them at the forefront of international finance.

Elon Musk

Elon Musk continues to reign in the financial realm in 2024 with a net worth exceeding $251 billion. While most of Musk’s fortune is rooted in his holdings in Tesla and SpaceX, he has also explored other ventures, such as the social media platform X.

Musk’s investment and trading behaviors are notoriously unpredictable, much like his business endeavors. He frequently grabs headlines with his daring, unconventional market moves. His ventures into artificial intelligence, space travel, and renewable energy position him to potentially become the first trillionaire by 2027.

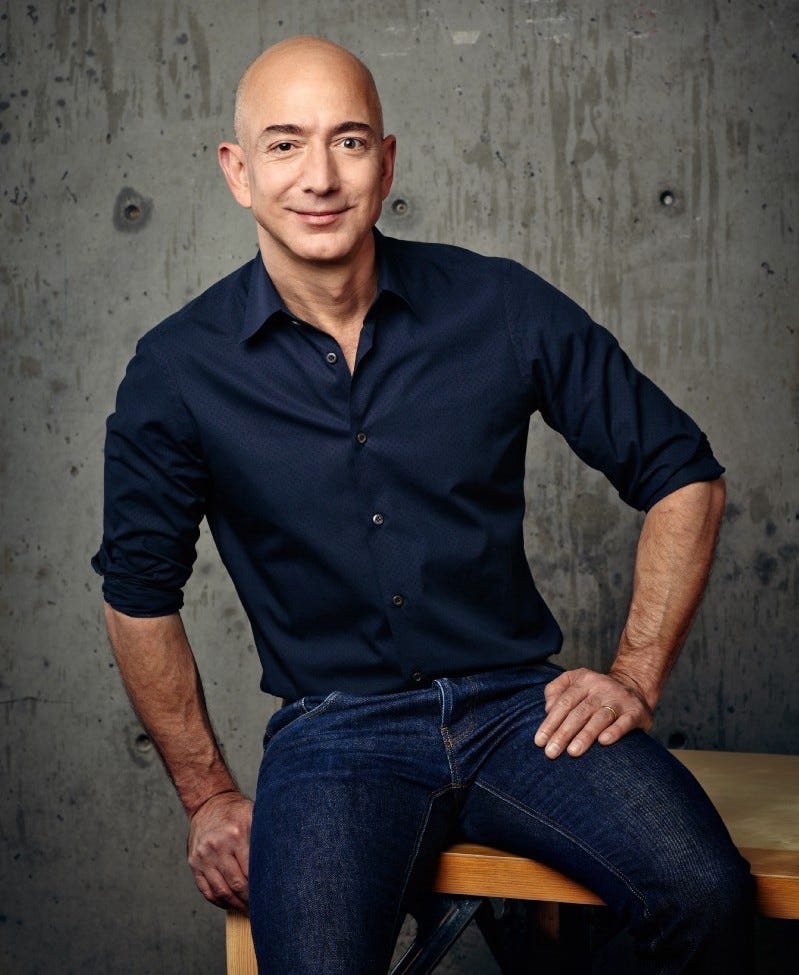

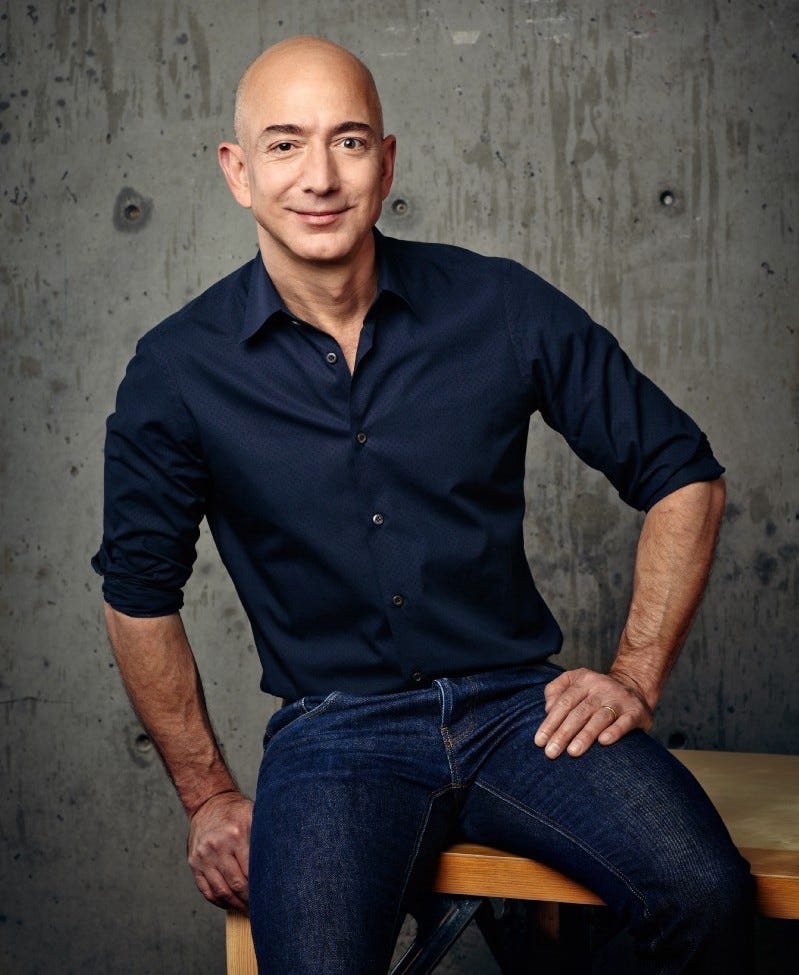

Jeff Bezos

Jeff Bezos — the Amazon founder — has accumulated a fortune surpassing USD 190 billion, placing him among the wealthiest alongside Musk and Arnault. Despite stepping down as Amazon’s CEO in 2021, his influence within the financial sphere has only intensified.

Bezos excels in strategic diversification, extending his investments beyond e-commerce into various sectors such as space exploration, media, and real estate. His real estate holdings are valued at over half a billion, featuring luxury properties in New York, Washington, D.C., and Los Angeles.

One of Bezos’s standout ventures is Blue Origin, his private aerospace company. He’s also significantly invested in the media sector, with the 2013 acquisition of The Washington Post strategically enhancing his influence there.

Bernard Arnault

Bernard Arnault, chairman and CEO of LVMH, remains among the wealthiest individuals globally, with a fortune exceeding USD 180 billion. Much of his wealth is derived from luxury brands like Louis Vuitton and Christian Dior, yet Arnault continues to expand his empire by diversifying into various investment domains.

Arnault approaches wealth management systematically, with active investments in art, real estate, and technology.

Billionaire Strategies: Diversification and Long-Term Vision

A prevalent trend among billionaires in 2024 is their strategic use of diversification to protect their wealth. Warren Buffett, the “Oracle of Omaha,” advocates for long-term value investing through his company, Berkshire Hathaway.

Buffett’s philosophy of purchasing and holding high-quality stocks over time has proven successful, with his net worth reaching USD 144.5 billion. His strategy sharply contrasts with more volatile traders like Musk, yet both illustrate the necessity to adapt to individual financial objectives.

Diversification is similarly evident in the portfolios of Larry Page and Sergey Brin, Google’s co-founders. These billionaires heavily invest in technology, AI, and renewable energy, spreading their wealth across various sectors and regions to minimize risk.

How to Utilize Professional Tools to Invest Like Billionaires

Billionaires frequently leverage advanced analytics and state-of-the-art tools to guide their investment decisions. They manage their wealth combining personal insight and expert advice that facilitate navigation through complex markets. They often employ teams of analysts, utilize sophisticated technology, and embrace risks for higher gains.

For most everyday investors, achieving this level of access might seem unattainable. However, modern trading platforms like OANDA enable trading significant sums without the constant worry about financial losses.

OANDA Prop Trader users can access virtual funds ranging from USD 10,000 to USD 500,000. Traditionally, prop trading was limited to large financial firms, yet companies like OANDA have made it accessible to individual traders.

OANDA’s Prop Trader Challenge is designed to evaluate traders’ skills in risk management and profit generation. Successfully passing this challenge opens access to real-time trading tools and potential profit-sharing opportunities of up to 90 percent. This means that, similar to billionaires who surround themselves with market experts, you can also gain an advantage through data-driven insights, high-level tools, and institutional-grade market access.

Billionaires Leading the Future of Investing

In 2024, billionaires are not just accumulating wealth through their enterprises but are also leading the way in global financial markets with bold, diversified investment strategies. As they continue to redefine traditional and speculative investments, they remain sources of intrigue — and at times, inspiration — for aspiring investors. Their ability to combine advanced technology with long-term strategies provides invaluable insights into the importance of agility and diversification in today’s unpredictable financial landscape.

For the latest business news and billionaire insights, click here.