Stichting Pensioenfonds ABP Sells Tesla Stock

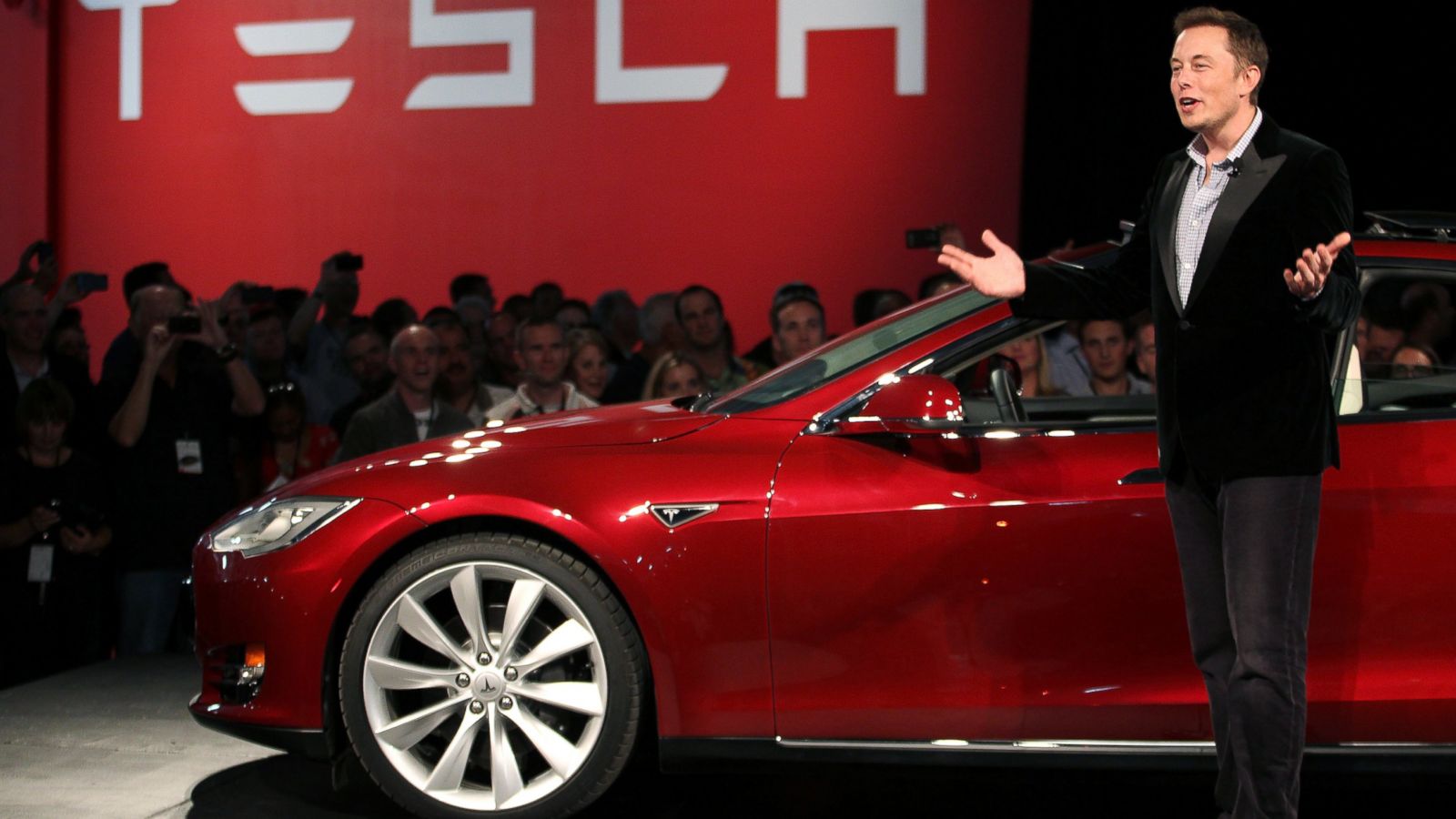

In an unexpected move, Europe’s largest pension fund, Stichting Pensioenfonds ABP, has completely divested its holdings in Tesla Inc, a stake valued at €571 million (roughly $585 million), during the third quarter. This decision comes amidst concerns about Elon Musk’s compensation package and criticism regarding working conditions at the automaker. As reported by Dutch newspaper Het Financieele Dagblad, a spokesperson for ABP shared with Bloomberg, “We had a problem,” referring specifically to Musk’s staggering $56 billion pay package approved by shareholders in June 2024—a package that ABP opposed for being “controversial and exceptionally high.” The fund’s decision to pull out also factored in considerations around costs, returns, and responsible investments.

Loss or Gain?

This decision by ABP means the fund misses out on potential future gains, particularly following the spike in Tesla’s stock value after the 2024 elections. Initially, Musk’s stock options were valued at $2.6 billion, but they soared to $56 billion before a judge canceled the package. Currently, Tesla boasts a market value of approximately $1.27 trillion, with its stock climbing about 74% over the past year. Interestingly, while Tesla’s Model Y became the top-selling car in the Netherlands in 2024, the company’s overall sales are on a downward trend in Europe. New registrations for Tesla vehicles dropped over 15% from January to November 2024 compared to the same period in the previous year, according to data from the European Automobile Manufacturers Association.

Rising Competition

At the same time, emerging competition from Chinese automakers like BYD and NIO is posing a significant challenge to Tesla’s dominance in the Asian market. These companies are not only offering similar technologies at better prices but, in many instances, outperform Tesla in terms of battery range and features. China has long viewed electric vehicles (EVs) as a strategic industry, investing over $230 billion in subsidies and international projects to enhance its capabilities in low-cost EV manufacturing. This substantial support for local manufacturers places Tesla at a considerable disadvantage, and the company may find it increasingly challenging to maintain its competitive edge against local powerhouses.

In a statement to the NL Times, ABP emphasized, “We cannot and do not need to invest in everything,” indicating that the decision to withdraw was not influenced by political motivations. Notably, Musk has openly supported President-elect Donald Trump and co-leads a commission focused on government efficiency. Following the election, Tesla’s stock saw remarkable growth, achieving record values in 2024—this surge significantly boosted Elon Musk’s net worth to $400 billion. The stock opened at $201.02 on July 1 and rose to $261.63 by the end of September, showcasing impressive fluctuations within that timeframe, reaching a low of $182.00 and a high of $265.60.

Play for Politics

Outside of stock fluctuations, there’s increasing tension within the right-wing movement concerning Elon Musk’s growing influence. Some conservative figures are expressing dissatisfaction with his role in Republican politics. A report by the Times of India highlights Musk’s support for H-1B visas, which stands in contrast to individuals like Steve Bannon, who view such measures as detrimental to American workers. Bannon’s criticism even touches on Musk’s South African origins, leading him to suggest that Musk should “go back to South Africa.” This conflict underscores deeper ideological divides within Trump’s political faction.